The Untold Forth Option That May Benefit You

Do you own life insurance? A perfect storm has been developing in the life insurance industry that rivals the recent destruction of Irma, Nate and Harvey. So, what’s happening and how can you potentially benefit from the chaos?

Well one of the big factors is that interest rates have been kept at artificially low levels over the past several years. This environment has caused a tremendous amount of stress on the life insurance industry. You see, insurance carriers make their money on the interest rate spread in the policy. For example, if the carrier is crediting a 4 percent rate to a policy, it needs to generate higher returns than 4 percent to make money. In today’s low-interest rate environment, the carriers are not only NOT making money on the interest rate spread, they are, in fact, losing money. The result is that carriers have raised the premiums (cost-of-insurance) to offset the low-interest rates and to attempt to increase their profits on these older policies. A growing number of life insurance policyholders are seeing their annual premiums suddenly double or triple. As a result, many have felt compelled to surrender or lapse their policies. Some have even joined class-action lawsuits against their insurance carriers.

Here are some other things happening that compound this situation:

- Many people who are paying premiums for policies they will probably not use.

- The complexity of life insurance products is overwhelming for consumers.

- Most policies are not even being managed by a professional and have the “set it and forget it” approach.

If your policy is at risk, the insurance companies will tell you that you have essentially three options:

- Surrender your policy now or allow your policy to ride as long as possible with the new increased costs.

- Reduce the face amount of your policy to keep the policy inforce as initially designed.

- Increase the planned premiums to keep the policy inforce as initially designed.

Insurance companies won’t tell you a fourth option exists, an option that has the potential to greatly benefit appropriate policyholders and recover a portion of their policy’s value. A Life Settlement may be your most prudent choice. A Life Settlement is an option for individuals or businesses who no longer need or want their life insurance policy or may require funds for other needs. The following are examples of situations where they shine:

- If your insurance company has unexpectedly increased the cost of your policy making it unaffordable.

- If your current policy is underperforming, the need for insurance may still exist, but you want coverage that has better guarantees.

- If you think you will outlive the maturity date of your life insurance policy.

- Estate tax exemption thresholds have been raised, making estate planning life insurance unnecessary.

- If funds are needed to focus on retirement, long-term care insurance, or family emergencies.

- If your business is sold or changes are made within your Buy-Sell Agreement that result in your insurance no longer being needed.

- If you have charitable-owned policy has been under-performing and needs to be replaced in order to preserve the benefit to the charity.

Just like your home, automobile or business, life insurance is a capital asset. What is a life settlement? It is the sale of an existing life insurance policy on the secondary market to a third party for fair market value. The owner sells policy in exchange for a lump sum settlement that can be higher than cash surrender value. The third party institutional investor who becomes the owner of the policy, makes premium payments and collects the death benefit at the insured’s death. With institutional investors, policies are owned in large blind trusts with other policies.

To have a better idea of how these strategies can significantly benefit people, here are a few real-life examples.

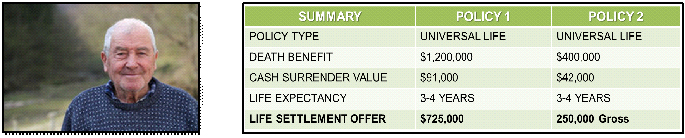

THE FIRST SITUATION: Robert Jones1, an 88-year-old retired entrepreneur, had several insurance policies originally purchased ten years ago to offset estate taxes on his death. With the recent increases in the estate tax exemptions, there was no longer a need for the insurance coverage. In addition, the original level premium was no longer sufficient to continue funding the policies at a guaranteed level to age 100. Robert did not want to pay the increased premiums. We worked with multiple providers to negotiate settlement offers through their auction process, resulting in a total gross offer for both policies of $975,0002 or 60 percent of Robert’s total death benefit. 2

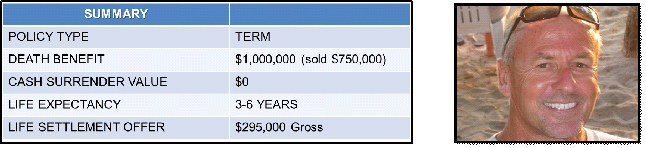

THE SECOND SITUATION: Ted Bailey1, a 59-year-old business owner, has experienced challenges with his family business. As a result, he was forced to file bankruptcy to discharge business loans for which he was responsible. Ted had a $1 million term policy which needed to be converted within the next several months. However, he could not afford to pay the premium for a permanent policy. After consulting with us, Ted decided to sell $750,000 of the term policy and retain $250,000 of term coverage. We worked with multiple providers to negotiate settlement offers resulting in a gross offer of $295,0002 plus reimbursement of the first quarter’s premium. The gross offer was 39 percent of the total death benefit.

Are you a candidate for a Life Settlement? To determine if a life settlement may be the best potential course of action for your policy, there are several general criteria to consider at the outset.

- Individuals age 65 and older

- A decline in health since your policy was issued

- A life expectancy of 15 years or less

- Life insurance policies with a death benefit of $250,000 or more

- Owners can be an Individual, Trust, Corporation or Charity

Life Settlements are extremely complex transactions as we turn a policy into a marketable security, create the market and bring only vetted buyers to the auction. In most cases, we can secure offers that can be thousands, even hundreds of thousands of dollars for the policy holder. We voluntarily over regulate each transaction by treating all sales of all policies as a security. Our only fiduciary responsibility is to the seller of the policy and they are afforded the same protection they would receive with any security transaction. We are honored to be the only Oregon firm licensed in the state of Oregon to offer Life Settlements.

It is impossible to predict exactly which providers will have the strongest offer at any given time, so it is crucial to have a consistent and written process that finds this offer for you. A formal, systematic bid process that forces all providers to play on the same level playing field and awards cases strictly on the merit of the provider making the highest offer which allows consumers to know they are receiving a true fair market value for the sale of their policy.

-

Client name has been changed to protect confidentiality.

-

The gross offer will be reduced by commissions and expenses related to the sale.