‘The cost of doing business’: Bills at the Capitol target credit card swipe fees

AUSTIN, Texas (KBTX) -The Texas Legislature is considering two bills aimed at increasing transparency around credit card fees, small business owners and industry leaders say those charges are taking a growing toll—and quietly driving up costs for consumers.

“Texas businesses and in our case, Texas restaurants pay the highest credit card interchange type fees essentially in the industrialized world,” said Emily Williams Knight, President and CEO of the Texas Restaurant Association. “This session, we’re really trying to bring transparency to what both merchants, but also consumers here in Texas pay.”

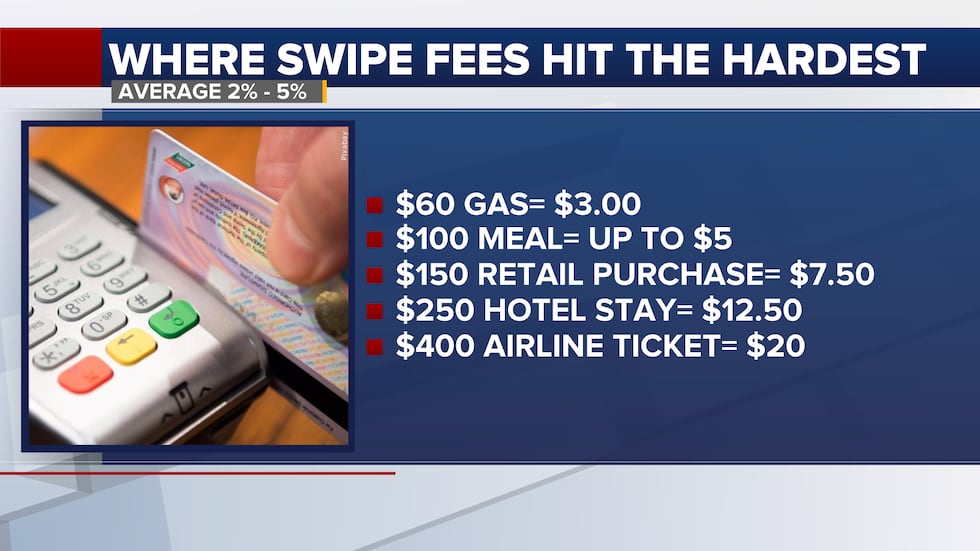

Swipe fees vary by industry, but they all add up fast. restaurants, retailers, and even airlines lose 1.5 to 3.5 percent on every credit card sale. According to Nerd Wallet for every $100 purchase the business has to pay out between $1.50 to $3.50 per transaction, a cost that ultimately gets passed to the customer.

The legislation—Senate Bill 2056, authored by Sen. Kelly Hancock, and House Bill 4061, authored by Rep. Jared Patterson—would:

• Ban swipe fees on sales taxes and tips, which businesses are required to collect and remit to the government;

• Require monthly credit card statements to include a clear line showing how much in swipe fees a consumer paid;

• Prohibit price fixing among credit card issuers or payment networks;

• And allow merchants to offer discounts to customers who use cash, debit, or gift cards—without facing penalties from credit card companies.

“Most Texans don’t understand that they pay anywhere from 2 to 3 1/2 percent when they purchase an item,” Knight said. “So if I buy a pair of shoes for $100, let’s say $3.50 of that is what we would call an interchange or swipe fee.”

The Texas Restaurant Association and other business groups argue that the fee system is both hidden and inflexible.

“Our restaurants have no ability to negotiate these fees,” Knight said. “They can’t sit down and actually decide or negotiate those fees, due to the size of their businesses. So they’re at the whim of whatever card you pull out of your pocket.”

Chelsey Sweidan, owner of Evie + Oak, a children’s boutique in College Station, says she sees those fees every day.

“For every transaction that we do, there’s between a 3 to 4% fee plus a little bit of an extra fee,” Sweidan said. “That’s not something we want to pass on to the customer. That’s something we have to take on ourselves.”

Restaurants are particularly strained, Knight said, because they’re already burdened by rising costs of food, labor, insurance and rent.

“If you look at that cost structure on a 5 to 6% margin business, there isn’t anywhere for them to absorb those costs,” she said. “We truly believe it’s why we still have restaurants that are closing.”

Some restaurant owners report needing to sell hundreds of additional meals per week just to cover swipe fees.

“You have to sell more—in some cases, members are calling saying, ‘I’d have to sell another 1,100 BBQ plates a week to cover the swipe fee,’” Knight said.

Testimony from the State Capitol

At Shipwreck Grill in Bryan, owner Wade Beckman says the monthly cost is hard to ignore.

“For a small business, I would say they’re paying somewhere between $3,000 and maybe up to $10,000 in credit card fees per month,” Beckman said. “With inflation, labor costs—everything from COVID till now—we’ve all taken a huge hit. Something like this could put us closer to where we were.”

Asked what that extra money could mean for his restaurant, Beckman didn’t hesitate.

“It just allows us to operate a better business,” he said. “To reward employees, to take care of the business needs… and for some owners, to make a better living.”

The bills also seek to increase public awareness by requiring disclosure of fees on receipts and monthly statements.

“I think consumers in Texas will be shocked that they are paying an extraordinary amount of money for the use of their credit card,” Knight said. “We believe in transparency. We believe both consumers and merchants should understand what they’re being charged.”

Ashton Rea, a customer at Evie + Oak said she supports the idea.

“I think that’s a good idea because people may not be aware of that,” she said. “It might be something good just to create that awareness for people to realize where that money is going.”

Knight emphasized that other countries have already taken action.

“Those swipe fees have gone down [in places like] Canada, Europe and the UK as ours have more than doubled,” she said. “We need to bring awareness, and that’s only going to be through other businesses and even Texas consumers signing on to the petition.”

The Texas Restaurant Association and a coalition of business groups are backing the effort through Texans Against Hidden Credit Card Fees, a coalition of Main Street businesses and consumers who are working together to advocate for greater competition, transparency, and fairness within Texas’ credit card market.

“We have to do something this session to fix these costs,” Knight said.

Not everyone is on board. Airlines for America, a trade group representing major U.S. carriers, sent a letter to Sen. Charles Schwertner and members of the committee opposing the bills. The group argues the proposed requirements could disrupt a payment system that supports credit card rewards programs, including airline miles and travel points that many Texans use and value.

In the letter, A4A warned the changes could threaten consumer benefits, create privacy concerns through new transaction databases, and undermine a fast, standardized payment network that “operates in milliseconds.” They also cited economic impact, noting that more than 1.2 million domestic passengers used airline miles to travel to Texas in 2023, contributing over $1 billion in visitor spending.

“These rewards programs also bring thousands of visitors to Texas and are a critical part of the tourism sector. In fact, close to 1,260,000 domestic passengers used miles from airline co-branded credit cards to visit the state of Texas in 2023, driving $1.01 billion in visitor spending and $83 million in state and local tax revenue,” the letter said. “SB 2026 and HB 4124 introduce unnecessary risks to these important sources of value and economic contribution across the state’s economy. On behalf of A4A and our member carriers, we oppose any mention in the bill that would require a separation of nearly every electronic payment transaction into multiple parts.

Copyright 2025 KBTX. All rights reserved.