- Exclusive

- Editors Desk

- 7 min read

"ARCs aid balance sheet cleanup but lack capital and operational strength": Anita Shah, Joint Secy at MCA

Anita Shah, Joint Secretary at the Ministry of Corporate Affairs, advocated a balanced approach to India’s bad loan crisis. She praised the Insolvency and Bankruptcy Code (IBC) for improving transparency and resolution speed since 2016, despite judicial delays and low recovery rates. While acknowledging Asset Reconstruction Companies' (ARCs) role, she flagged their funding challenges. Shah also warned against excessive sovereign guarantees due to moral hazards and fiscal risks.- Exclusive

It's free content, simply login/signup to unlock

Get in-depth Industry Insights and Analysis through our “Exclusive” content, presented to you by our esteemed panel of writers, for free

By continuing, you agree to the T&C, Privacy Policy and Prohibited Content Policy. This same account can be used across all ET B2B portals.

If India is to fix its bad-loan crisis, it must rethink the model—balancing regulatory oversight with the flexibility needed to revive stressed assets—before further challenges undermine investor confidence.

On April 1 2025, Anita Shah, Joint Secretary at the Ministry of Corporate Affairs, emphasized the importance of a balanced approach in tackling India’s growing bad loan crisis. She assessed the roles of the Insolvency and Bankruptcy Code (IBC) and Asset Reconstruction Companies (ARCs) while warning against excessive dependence on sovereign guarantees.

In a detailed analysis shared on LinkedIn on April 1, Shah outlined the strengths and shortcomings of both mechanisms. The IBC, implemented in 2016, has enhanced transparency and expedited insolvency resolutions but continues to grapple with challenges such as judicial delays and suboptimal recoveries.

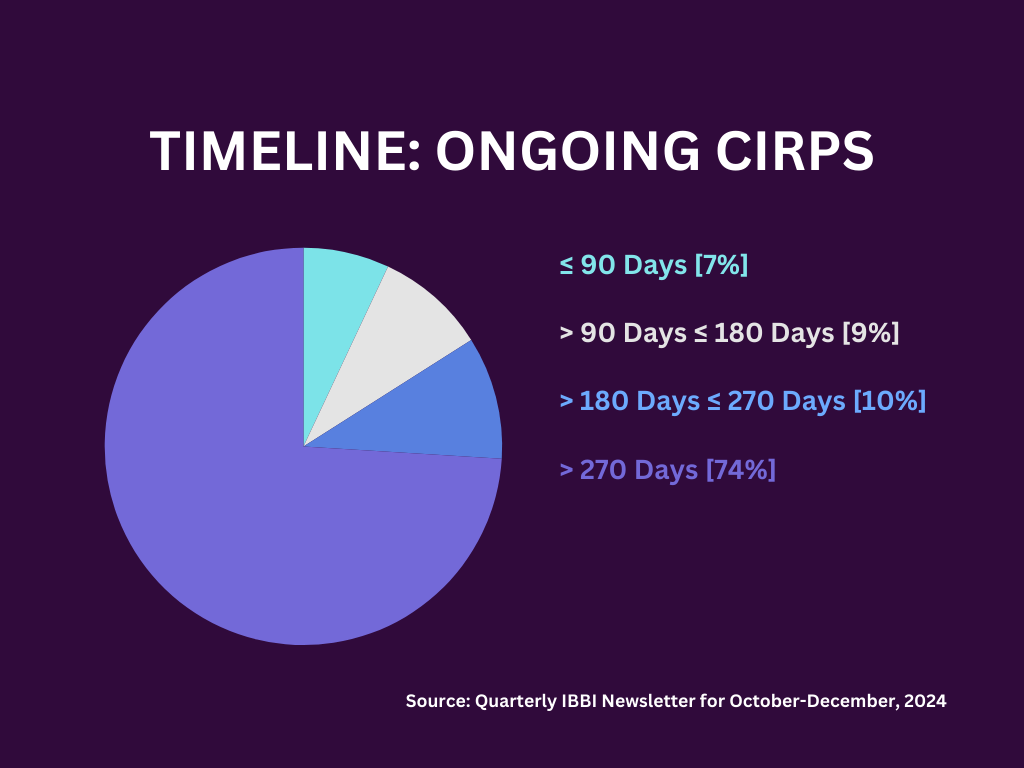

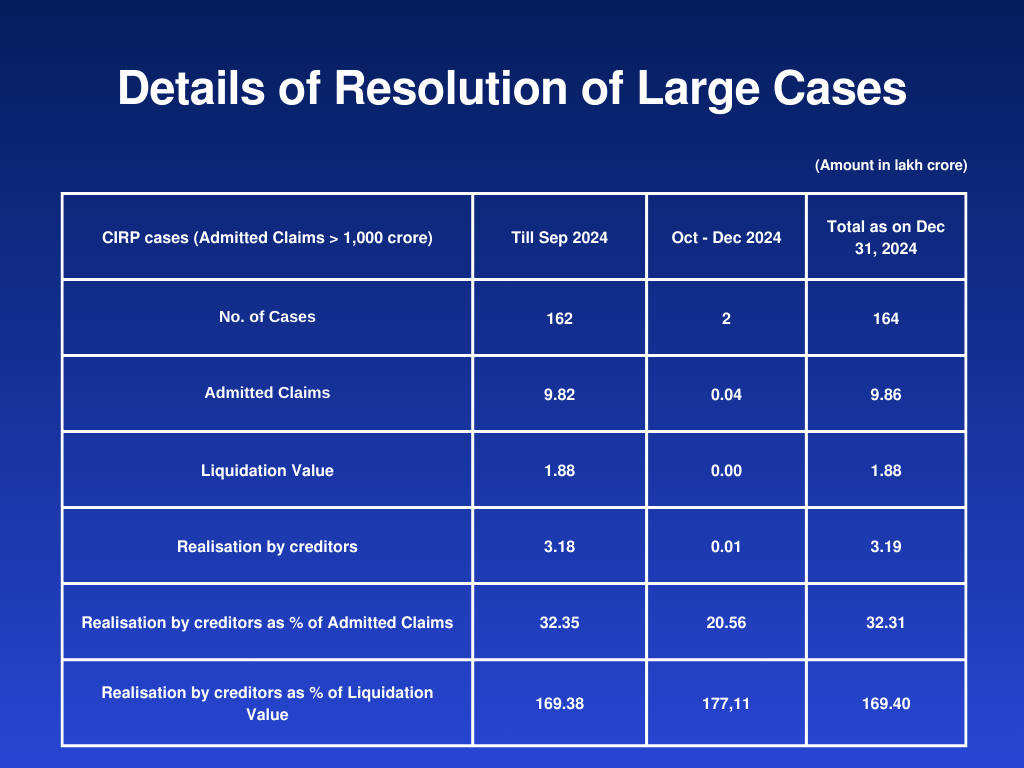

“While the IBC’s time-bound, creditor-driven model is revolutionary, procedural bottlenecks and frequent amendments have diluted its efficacy,” she noted. Creditors, she pointed out, often recover less than 40% of claims.

Regarding ARCs, Shah recognized their traditional role in managing non-performing assets (NPAs) but pointed out their limited effectiveness, attributing it to funding constraints and an emphasis on recovery over resolution. “ARCs, though useful for balance-sheet cleanup, lack the capital and operational heft to revive stressed assets meaningfully,” she observed. However, she hinted at a potential revival with government-backed initiatives like the National Asset Reconstruction Company Limited (NARCL or “bad bank”).

Shah reserved sharp criticism for the pervasive use of sovereign guarantees on bad loans, warning of moral hazards and fiscal risks. “Blanket guarantees encourage reckless lending, distort market discipline, and shift the burden to taxpayers,” she wrote, advocating for targeted interventions instead.

Shah advocated for a comprehensive strategy, emphasizing:

- Enhancing the IBC: Accelerating adjudication, reducing judicial bottlenecks, and ensuring stricter enforcement.

- Revamping ARCs: Injecting capital and broadening their role from mere recovery to business revival.

- Restricting Sovereign Guarantees: Reserving government support for exceptional cases to safeguard fiscal stability.

Yet, the Srei Infrastructure Finance Ltd. case exemplifies how even well-intentioned mechanisms can falter, delivering suboptimal recoveries and eroding shareholder value despite higher bids from original stakeholders.

The Srei Saga: From Prominence to Peril

Srei Infrastructure Finance Ltd., founded in 1989 by Hemant and Sunil Kanoria, was a trailblazing NBFC that fueled India’s infrastructure boom, financing power, roads, and ports with a loan book exceeding Rs 30,000 crore. It thrived in high-risk sectors shunned by banks, backing projects like GMR’s Tannir Bavi power plant and recovering dues from defaulters like Kingfisher Airlines. Surviving the 2018 IL&FS crisis through innovative strategies like securitization, Srei’s resilience was notable—its 2020-21 financials showed a Rs 150 crore profit and an 18% capital adequacy ratio.

Trouble emerged in 2020 when major borrowers, with loans over Rs 1,000 crore, resisted repayment demands, straining Srei’s cash flow. The COVID-19 pandemic worsened this mismatch: while Srei’s borrowers enjoyed moratoriums, the NBFC faced unrelenting debt obligations to banks, despite no defaults in 32 years. In October 2021, the Reserve Bank of India (RBI) intervened, superseding the boards of Srei Infrastructure and its subsidiary, Srei Equipment Finance Ltd., citing undisclosed complaints and alleged instability. The RBI pushed both into IBC proceedings—a move questioned given Srei Infrastructure’s minimal external debt and Srei Equipment’s clean payment record.

In February 2023, Adisri Commercial Pvt. Ltd., representing the Kanoria family, proposed a Rs 32,000 crore settlement under IBC’s Section 12A to regain control, offering full repayment to creditors via upfront cash and financial instruments over five years—the highest bid among contenders. Adisri petitioned the Kolkata NCLT, alleging the RBI-appointed administrator, Rajneesh Sharma, rejected their plan without Committee of Creditors (CoC) input, overstepping his authority.

Adisri in its petition to NCLT requested the tribunal to direct the administrator to consider its settlement application under Section 12A of the IBC.

“The applicant submitted a settlement proposal dated February 6, 2023 without prejudice to its rights and contentions and has requested the administrator (Rajneesh Sharma) to consider the same under Section 12A of the IBC 2016,” the petition said. The settlement proposal was for both Srei Infrastructure and Finance Ltd (SFIL) and its subsidiary Srei Equipment Finance Ltd (SEFL). The petition alleged that the administrator had, on his own accord, rejected the proposal dated February 10, 2023.

The applicant contended that the administrator had no authority to adjudicate on the merits of the settlement proposal. "It is the duty and obligation of the administrator to forward the proposal for consideration to the committee of creditors (CoC) and thereafter inform the applicant of the result, and it does not appear from the letter dated February 10 that the CoC has taken any decision on the settlement proposal of February 6, 2023," it said.

SIFL has no external debt and SEFL has no default, as it was under the Section 10A regime of the Supreme Court, the petition said.

Despite Adisri’s highest bid offer among all the bidders, the Kolkata bench of NCLT in August 2025 approved the resolution plan submitted by NARCL for the twin Srei companies once owned by the Kanoria family. NARCL's proposal valued the assets at Rs 5,555 crore on a net present value (NPV) basis, compared to Adisri's offer.

The total value of NARCL's resolution plan stands at Rs 14,301 crore, which comprises a cash component of Rs 3,001 crore, debentures and security receipts worth Rs 3,300 crore, and an uncommitted payment of Rs 8,000 crore through Optionally Convertible Debentures (OCDs). These payments are conditional and will be recovered from the underlying assets over the next seven years. Creditors accepted a haircut of 55 per cent in view of the full recovery potential of the uncommitted Rs 8,000 crore, with the total claims of the financial creditors amounting to Rs 32,750.22 crore.

Under NARCL’s plan, recoveries are structured to align with prevailing market conditions, with outstanding dues settling at 20-30% of their value—a range consistent with the broader 40% recovery ceiling under the IBC. While shareholders have experienced some devaluation and employees have faced challenges, the Srei case underscores the intricate balance required in resolving stressed assets and highlights the need for ARCs to enhance their operational capabilities for effective revival.

Expanding the Bad Bank Model: Recent Acquisitions

Building on the Srei experience, NARCL has extended its footprint by acquiring outstanding loans from additional defaulting companies. Last month, NARCL emerged as the sole bidder to take over the outstanding lenders’ debt of McLeod Russel India Ltd (MRIL) with an offer of ₹700 crore. The Khaitan family-promoted bulk tea producer owed ₹1,104.69 crore in principle to a consortium of lenders led by ICICI Bank. NARCL’s offer represented a 36.6 per cent haircut—a move that comes after six years of efforts to restructure McLeod’s debts.

Recently, NARCL, which had placed the anchor bid for the State Bank of India-led consortium’s non-performing loans (NPLs) in Jaiprakash Associates Ltd. (JAL), emerged as the sole bidder to acquire the assets after no counterbids were received. NARCL has made an offer of Rs 12,000 crore to acquire the debt of 25 lenders on a 15:85 cash to security receipts basis, triggering a Swiss challenge auction. This anchor bid translates into a recovery of 23 per cent for the lenders, following an earlier offer of Rs 10,000 crore that was subsequently increased. JAL’s total dues stand at Rs 50,000 crore.

Historical Parallels: ARCs Overreaching

Here is a look at cases where ARCs, tasked with asset resolution, faltered when managing businesses:

Lanco Infratech: Defaulting on Rs 45,000 crore in 2018, Lanco’s debt went to Edelweiss ARC, which, lacking infrastructure expertise, couldn’t overcome regulatory delays and market woes, leading to liquidation in 2019 with minimal creditor recovery.

Videocon Industries: With Rs 40,000 crore in debt, Videocon’s 2018 handover to Visionary ARC saw a failed revival attempt. Operational missteps led to bankruptcy in 2020, with assets sold to Vedanta for Rs 2,962 crore—a fraction of the total debt—eroding shareholder value.

Japan’s AMA: After the 1990s real estate crash, AMA managed distressed assets but lacked the business acumen needed, resulting in asset sales at losses after prolonged struggles.

Korea’s KAMCO: In 1997, after taking over Daewoo Motor, KAMCO’s inexperience in the auto sector led to a discounted sale to General Motors in 2002, reflecting a similar undervalued resolution.

The Bigger Picture: Charting a New Course

At its core, a bad bank like NARCL is meant to clean up balance sheets, not run businesses. Srei’s experience and the recent acquisitions in the MRIL and JAL cases highlight the evolving nature of asset resolution in India. They underscore the need for ARCs to strengthen their operational capabilities and adapt to changing market conditions while ensuring transparent and efficient recovery processes.

If India is to fix its bad-loan crisis, it must rethink the model—balancing regulatory oversight with the flexibility needed to revive stressed assets—before further challenges undermine investor confidence.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions